Wealth Managers and Investors

Locked out of investable clean energy

Institutional deals are hard to access, with high minimums, opaque structures, and unclear exits.

The infrastructure platform that makes it easy to invest in real clean energy projects.

Australia’s clean-energy transition is being held back by viable projects that can’t secure finance. Private capital is willing, but deals are hard to access and poorly structured.

Locked out of investable clean energy

Institutional deals are hard to access, with high minimums, opaque structures, and unclear exits.

Great projects struggle to raise

Mid-scale (300kw-30mw) projects are too small for banks, too risky for institutions, and closed off for private capital.

We connect wealth managers, investors, and developers through a single platform that structures, verifies, and manages contract-backed solar and battery projects from funding to operation.

Contracted revenue arrangements underpin project stability and investor returns. In mid-scale and behind-the-meter projects, traditional bank-financed PPAs are often unavailable. RegenX works with developers and offtakers to structure bankable revenue frameworks, including revenue participation and energy service agreements, enabling private capital to access operating clean energy infrastructure.

RegenX unlocks liquidity with verified deal flow and a clear path to exit, making clean energy investments accessible, transparent and tradeable.

Institutionally structured clean energy projects, backed by bankable contracts and independent verification.

Invest in DSE Units through a compliant structure with clear terms, risk frameworks, and reporting standards.

Receive contracted distributions, track performance in real time, and access structured liquidity pathways.

RegenX gives investors access to infrastructure-backed cashflows through Digital Syndicated Energy (DSE) units, providing fractional unit exposure to these revenues.

Exposure to commissioned Battery Energy Storage System generating contracted cashflows.

Exposure to solar and battery projects in development and construction prior to operation.

Exposure to integrated solar, battery, and upgrade assets with tailored revenue structures.

RegenX provides wealth managers with the infrastructure to allocate to contracted clean energy exposure using portfolio construction principles such as income, duration, risk-adjusted yield, and liquidity, together with consolidated reporting.

Contractual rights, performance, and cashflows are tracked through secure systems for audit-ready reporting and verification.

Standardised transfer frameworks support secondary participation, portfolio rebalancing, and orderly exits.

Contract-backed infrastructure exposure designed to reduce correlation and improve income stability.

A unified dashboard providing visibility across performance, revenues, distributions, and risk metrics.

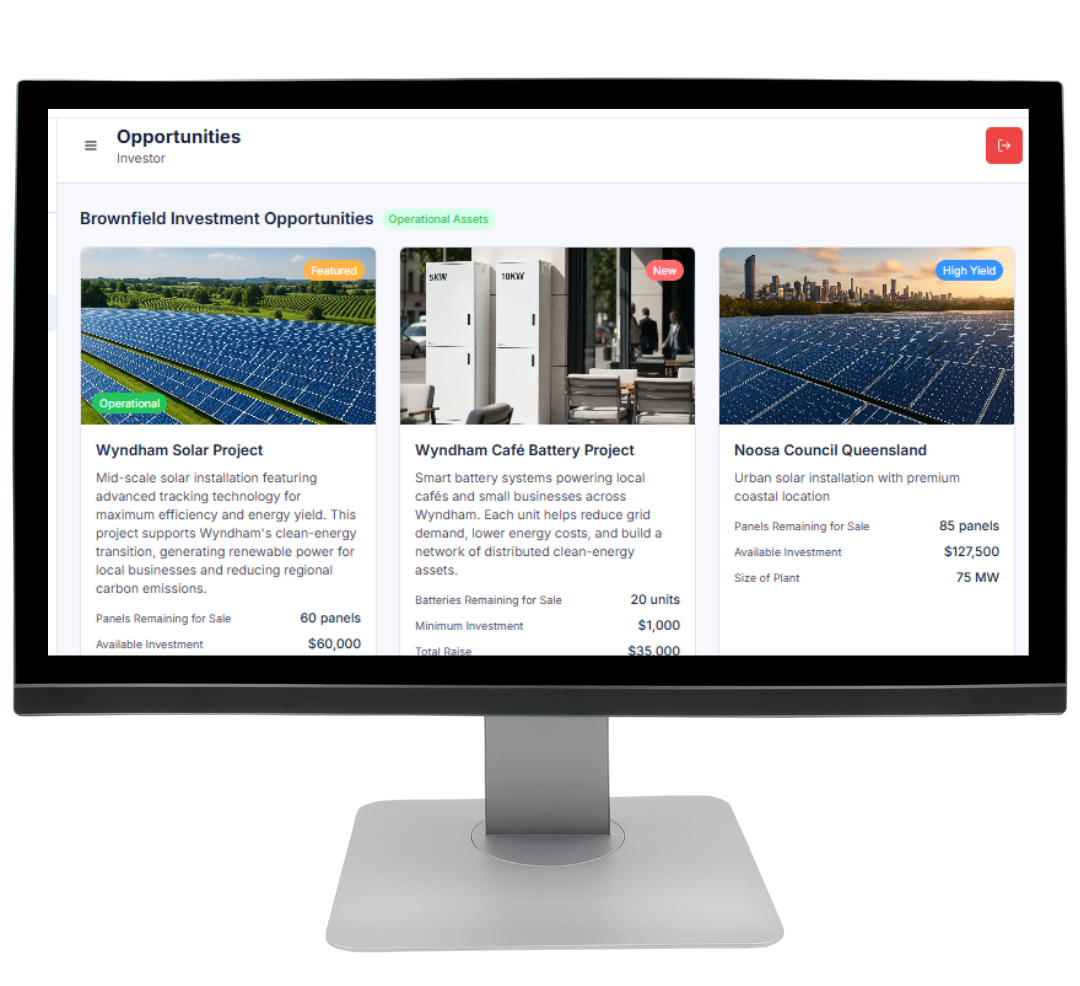

Browse Verified Projects

Full Access to Investments

List Project for Funding

Join RegenX to access verified, contracted-backed clean energy infrastructure investments with transparent structures and predictable income.

The ReFi Playbook is your insider look at tokenised clean-energy deals, investor sentiment, and tools shaping real-world climate assets. Short, practical updates for wealth managers and project founders.

SubscribeRegenX is an investment infrastructure platform. Investment products made available through the platform are structured and distributed in accordance with Australian financial services laws and are issued through our licensed AFSL holder. This website contains general information only and does not constitute financial product advice.